CPA Exam Credit Extensions

The California Board of Accountancy (CBA) has approved a series of credit extensions for the Uniform CPA Examination (CPA Exam) to assist candidates in the transition to the new version of the CPA Exam under CPA Evolution, and in response to the significant health, economic, education, and travel disruptions resulting in CPA Exam candidate hardships over the past several years.

- All exam credits that EXPIRED between January 30, 2020, and December 31, 2023, are once again valid and being extended until June 30, 2025.

- All exam credits valid on December 31, 2023, are being extended until June 30, 2025.

- All new exam credits earned beginning in January 2024 will be valid for 30 months, replacing the previous timeframe of 18 months.

Candidates do not need to do anything to take advantage of these extensions. The new credit dates will show up in their Client Account automatically. It is the CBA’s goal that these extensions will provide a renewed opportunity for candidates to pass all four sections of the CPA Exam and give them a longer period to do so, ultimately allowing them to follow through with their aspirations of becoming a CPA.

CPA Exam Credit Extensions FAQ’s

The CBA has approved a series of credit extensions for the CPA Exam to assist candidates in the transition to the new version of the CPA Exam under CPA Evolution, and in response to the significant health, economic, education, and travel disruptions resulting in CPA Exam candidate hardships over the past several years.

- All exam credits that EXPIRED between January 30, 2020, and December 31, 2023, are once again valid and being extended until June 30, 2025.

- All exam credits valid on December 31, 2023, are being extended until June 30, 2025.

- All new exam credits earned beginning in January 2024 will be valid for 30 months, replacing the previous timeframe of 18 months.

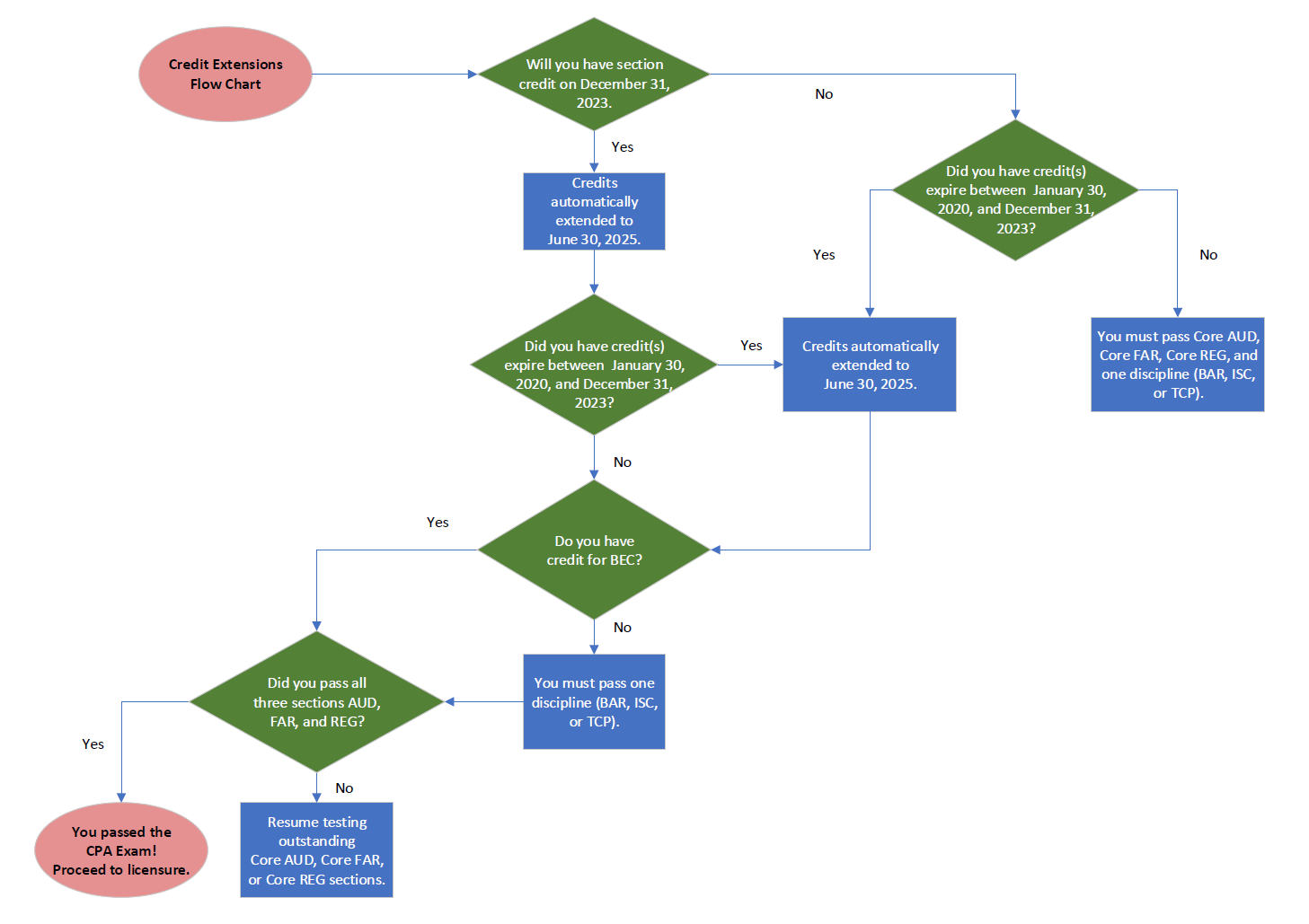

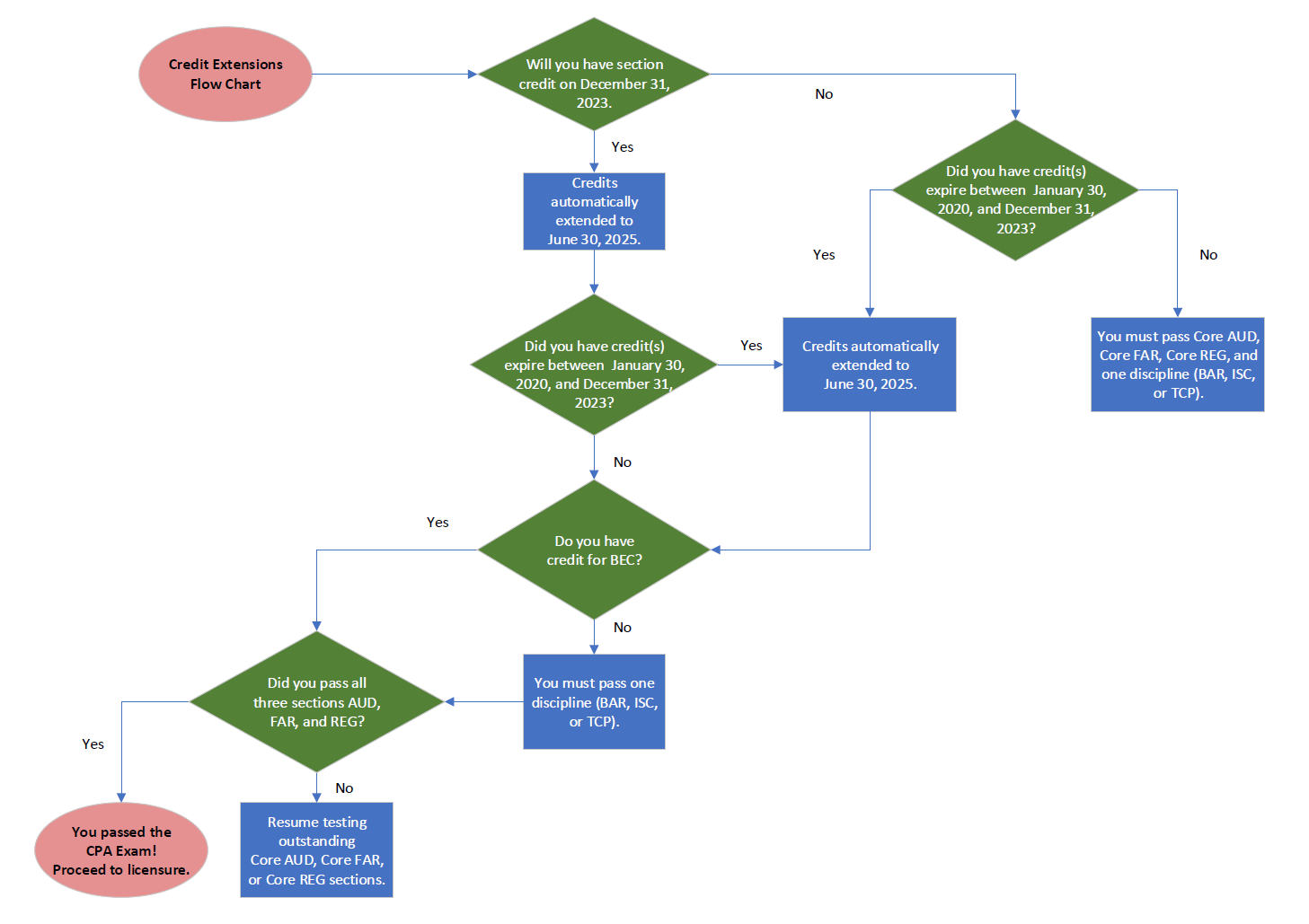

The Credit Extensions Flow Chart above depicts who is eligible for the credit extensions. The CBA will automatically update the client accounts of those qualifying for the extensions and will also notify them by letter. Please ensure your

Client Account has current contact information to receive CBA communications.

No action is required by you. Please monitor your

Client Account for more information.

One or more of three possible outcomes will appear in your

Client Account once updated:

- Any CPA Exam credit previously shown as EXPIRED (expired from January 30, 2020, through December 31, 2023) in the Credit Status column will now show as CREDIT with a new expiration date of June 30, 2025.

- Any CPA Exam credit that shows as CREDIT on December 31, 2023, will now show a new expiration date of June 30, 2025.

- If the credit extensions result in the candidate passing the CPA Exam, the Credit Status column will show PASS in all Exam Section rows.

Congratulations! The CBA will notify all individuals who pass the CPA Exam because of these extensions by email and physical letter and automatically update their

Client Account. No action is required by you. Please ensure your Client Account has current contact information to receive CBA communications.

No. Jurisdictions do not accept expired credits.

Client Account updates will occur in three waves. The first wave handled Extension #1 (the previously expired credits), and the new extension date became visible in Client Accounts on December 6, 2023. Extension #2 (for credits valid on 12/31) will be handled in two waves. The majority of candidates had their Client Account updated on December 7, 2023, but for those testing in the final weeks of the year, another update will occur on or around December 29, 2023. If you do not see your credits extended by January 2, 2024, please contact the CBA at

examinfo@cba.ca.gov or by phone at

(916) 561-1703.

After navigating to the

Client Account on the CBA website, click “log in” in the upper right-hand corner. On the next screen you will see a link to click if you have forgotten your password. Enter your username and click “Start password reset” to begin the process. Be sure to check your “spam” folder if you don’t initially receive the reset email. Copy and paste the new password into the password field to access your account.

Your username appears on your application remittance form directly above your date of birth. If you are unable to locate your username, please notify us by email at

examinfo@cba.ca.gov and we can send it to the email address listed in your Client Account.

If you have a new NTS, please contact

cri@nasba.org. You will need to cancel any appointment you made for the NTS. If you do not have a new NTS, there is nothing you need to do.

NASBA will issue refunds to candidates who canceled test sections by contacting them at

cri@nasba.org. They will not be able to issue a refund after a section was taken, if the candidate was a no-show, or if the NTS expired.

All CPA Exam sections passed beginning in January 2024 will have the new 30-month credit period.

No. Only new exam credits earned beginning in January 2024 are valid for 30 months. However, any exam credits valid on December 31, 2023, are extended to June 30, 2025.