Understanding the Professional Ethics (PETH) Exam Change

Watch this video for everything you need to know about the PETH Exam requirement change.

The implementation of the new CPA Exam that launched on January 10, 2024, has created a duplication of content in the Professional Ethics (PETH) Exam.* Therefore, as of July 1, 2024, the CBA no longer requires applicants to complete the PETH Exam for issuance of a CPA license. Instead, applicants need to complete a CBA-approved Regulatory Review Course for their first license renewal.

It is important to note, the CBA remains committed to protecting consumers, and this change does not reflect a relaxing or loosening of the requirements to become a CPA.

To ensure any money or time spent studying will not be wasted, any applicant licensed after July 1, 2024, who has passed the PETH Exam may use the passing score to satisfy the new Regulatory Review Course requirement or as two hours of technical continuing education at their first renewal. These options will be available through July 1, 2026, to ease the transition.

To receive the credit, the PETH Exam will need to be inputted as a course into CBA Connect. Here's how to do it:

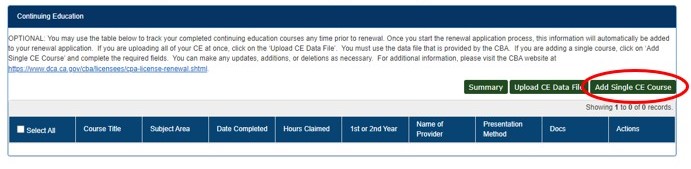

- Log in to your CBA Connect account and scroll down to the Continuing Education section of the Dashboard.

-

Click on the green button that says, "Add Single CE Course."

-

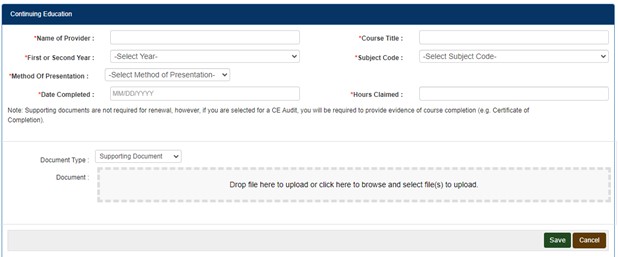

The "Add Single CE Course Box" seen below will appear.

-

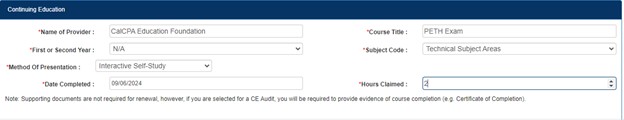

Within this box, enter the following data into each field:

- Name of Provider: CalCPA Education Foundation

- Course Title: PETH Exam

- First or Second Year (dropdown): N/A

- Subject Code (dropdown): Technical Subject Areas

- Method of Presentation (dropdown): Interactive Self-Study

- Date Completed: (enter your date)

- Hours Claimed: 2

- Supporting Documents: (none required)

- It is important that you DO NOT select "Board-Approved Regulatory Review Course" in the Subject Code dropdown menu. If "Board-Approved Regulatory Review Course" is selected, CBA Connect will ask for an approval number, which does not exist for the PETH Exam.

-

When your PETH Exam information has been entered, please click the green "Save" button to complete your entry.

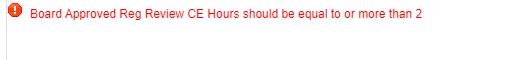

Please be aware you will receive the following error message when you try to submit your renewal:

- Click Continue and submit the application away. Once your license renewal application is reviewed, CBA staff will ensure the PETH score is applied to the Regulatory Review Course requirement, if no other regulatory review course was taken, or as two hours of technical CE.

*The California Department of Consumer Affair’s Office of Professional Examination Services reviewed the PETH Exam and determined that most of its topics are now covered in the new version of the CPA Exam. The new Regulatory Review Course requirement will fill in the gaps related to California-specific laws and regulations related to the practice of accountancy in the state. Additionally, many college courses embed ethics within their curriculum.

Replacement of PETH Requirement FAQs

What will be replacing the PETH Exam?

When does this rule change become effective?

I already passed the PETH Exam but haven't applied for licensure yet, what should I do?

I found a Regulatory Review Course online, but I can’t find it listed on the CBA website. Is it possible the CBA would accept it?

I already paid for the PETH Exam but have not completed it. Since it is no longer required, am I eligible for a refund?

Can I still take the PETH Exam?

I worked hard for my CPA designation. Why is the CBA loosening the requirements for licensure?

Do I still need to complete 4 hours of Ethics CE to renew my CPA license?

If I have further questions about the removal of the PETH Exam requirement, who may I contact?

Licensee Quick Hits

Upcoming Events