Attest Authority

Differences in Experience Completed (A vs G)

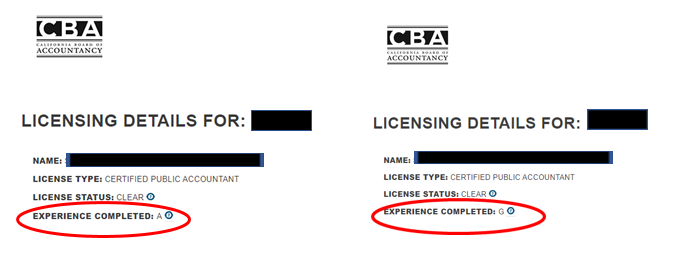

The CBA wants you to feel informed when choosing a CPA for your specific accounting needs. But since CPAs can provide a wide range of accounting services, how do you know how to select the right CPA for the service you need? Understanding exactly what services a prospective CPA provides and ensuring they align with your needs will lead to more successful business relationship. The first step is to verify the individual’s license using the License Lookup tool on the CBA website. When you do this, your search will pull up one of two results:

The Experience Completed field will show the letters A or G.

A: If you see an “A,” the CPA can perform all accounting services and is authorized to sign reports on attest engagements.

G: If you see a "G," the CPA can perform all accounting services, including preparing reports on attest engagements, but the CPA is not authorized to sign reports on attest engagements.

Attest Engagements include all intended items in the upper portion of the chart below: Audit reports, Review of Financial Statement reports, Prospective Financial Information reports, and Agreed Upon Procedures reports. The chart is provided as a guide to assist you in knowing what type of authority experience (A or G) a prospective CPA must have to perform the listed services.

| FINANCIAL SERVICES AVAILABLE BASED ON EXPERIENCE COMPLETED | ||

|---|---|---|

| Types of Services | With Attest Authority Experience: A |

Without Attest Authority Experience: G |

| Sign Reports on Attest Engagements | ||

| Sign Audit Reports | ||

| Sign Review of Financial Statement Reports | ||

| Sign Prospective Financial Information Reports | ||

| Sign Agreed Upon Procedures Reports | ||

| Perform Reports on Attest Engagements | ||

| Perform Audit Engagements | ||

| Perform Review of Financial Statement Engagements | ||

| Perform Prospective Financial Information Engagements | ||

| Perform Agreed Upon Procedures Engagements | ||

| Compilation Services | ||

| Financial Statement Preparation Services | ||

| Peer Review Services | ||

| *Bookkeeping Services | ||

| *Forensic Accounting & Litigation Support | ||

| *Tax Services | ||

| *Representation before Government Agencies | ||

| *Management and Consulting | ||

| *Information Technology Services | ||

| *Retirement Planning | ||

| *Estate Planning | ||

| *Financial Analysis and Planning | ||

*Can be performed by non-CPAs

In California, compilation services and signing compilation reports is not considered an attest engagement and can be performed by any licensed CPA.

After reviewing the chart and determining whether the CPA must have attest authority to perform the services you need, another important thought to consider is whether the CPA is qualified to do the work with professional competence, complying with applicable professional standards. It is the responsibility of the CPA to evaluate whether their specific education, experience, and judgment are adequate to perform the services being requested. This is why it is important for consumers to ask the CPA about their level and number of years of experience, continuing education, and recent peer review, if any.

For specific questions to ask a potential CPA, check out the CBA’s Consumer Assistance Booklet, a quick reference with helpful tips for selecting a CPA that’s right for you.

Listen to an episode of the “Accounting for California” podcast featuring an in-depth discussion on this topic:

Differences in Experience Requirements

If a “G” appears: All CPAs must complete a minimum amount (one year) of experience providing any type of service or advice involving the use of accounting, attest, compilation, management advisory, financial advisory, tax, or consulting skills. The experience may have been gained through employment in public accounting, private industry, or government. This CPA can perform a wide range of accounting services, including participating in attest engagements, but the CPA may not sign reports on attest engagements.If an "A" appears: In addition to the required experience listed above for all CPAs, if a CPA wants to sign reports on attest engagements, the services indented under the A column of the prior chart, they must also complete at least 500 hours of experience in attest services, the minimum amount of experience required to sign reports on attest engagements. This experience may have been completed before or after receiving their CPA license.

Consumer Quick Hits

Upcoming Events